|

Dasturchi |

InOut o’yinlari |

|

Ishlab chiqarilish sanasi |

4.04.2024 |

|

O’yin janri |

arkadalar |

|

Amaldagi qiyinchilik darajalari |

4 (oson, o’rta, qiyin, juda qiyin) |

|

O’yinchiga qaytish (RTP), %da |

98 |

|

Minimal tikish hajmi, EUR |

0,01 |

|

Maksimal tikish hajmi, EUR |

200 |

|

Maksimal ruxsat etilgan multiplikator |

Tikish x3 203 384,8 |

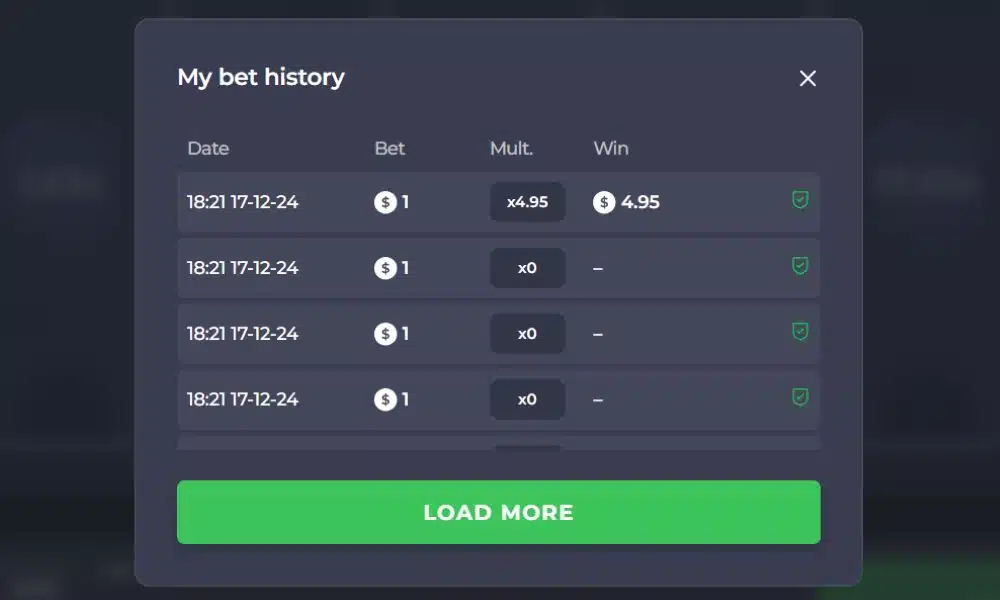

Chicken Road o’yinchilarga nafaqat nima bo’layotganini tomosha qilishni, balki o’yinda faol ishtirok etishni taklif qiladi. Bu erda biz bosh qahramonning harakatini nazorat qilamiz – tuzoqlardan qochib, ko’plab xavf-xatarlardan o’tishi kerak bo’lgan jasur tovuq. Agar u ulardan biriga kirsa, butun garov yonib ketadi va qahramon – afsuski – qovurilgan tovuqga aylanadi. Xarakterni boshqarishdan tashqari, biz tikish hajmi va qiyinchilik darajasini tanlash imkoniyatiga egamiz. Asosiy maqsad – finalga chiqish, bu erda bizni “Oltin tuxum” kutmoqda, bu ta’sirchan 20 000 evroga yetishi mumkin bo’lgan jekpot ramzi. Bunga erishish uchun nafaqat epchillik, balki ko’paytiruvchilar tizimi bilan birgalikda yuqori rentabellik (RTP) ham yordam beradi.

Demo rejimi va pul uchun o’ynang

Chicken Roadga yangi kelganlar uchun demo versiyasidan boshlashni tavsiya qilamiz. Oddiy mexanikaga qaramay, birinchi navbatda haqiqiy pulni xavf ostiga qo’ymasdan o’yinni boshqarish va mantiq bilan tanishib chiqish yaxshiroqdir. Demo rejimida hamma narsa juda oddiy: o’yin bepul, ro’yxatdan o’tish yoki depozitni talab qilmaydi va tikish virtual tangalar bilan amalga oshiriladi.

Va hatto demo rejimida ham, Chicken Road haqiqatan ham hayajonli va yoqimli – biz buni o’zimiz ko’rdik. Ushbu rejim nafaqat yangi boshlanuvchilar uchun, balki nafaqat g’alaba qozonish uchun, balki qiziqarli va yorqin his-tuyg’ular uchun o’ynaydiganlar uchun ham mos keladi.

Haqiqiy pul tikish uchun biz ishonchli onlayn kazinoni tanladik, tezda ro’yxatdan o’tdik, balansimizni to’ldirib, haqiqiy evro yutib olish imkoniyati bilan o’ynashni boshladik. Hammasi oddiy, qulay va xavfsiz bo’lib chiqdi.

Mobil versiya: istalgan joyda o’ynash erkinligi

Aksariyat zamonaviy o’yinchilar singari biz ham mobil telefondan o’ynashni afzal ko’ramiz. Bu qulay, chunki smartfon har doim qo’lingizda va siz o’yinni istalgan joyda – uyda, transportda, ta’tilda yoki tushlik tanaffusida boshlashingiz mumkin.

Chicken Road HTML5 texnologiyasidan foydalangan holda ishlab chiqilgan bo’lib, u turli xil qurilmalar: shaxsiy kompyuterlar, smartfonlar va planshetlar bilan to’liq muvofiqlikni ta’minlaydi. Biz kompyuterdan ham, telefondan ham o’ynashga harakat qildik – biz hech qanday farqni sezmadik. Interfeys ekran o’lchamiga moslashadi, barcha elementlar to’g’ri ko’rsatiladi, boshqaruv elementlari intuitiv bo’lib qoladi va o’yin barqaror va silliq.

Tovuq yo’li o’yin qoidalari: bilishingiz kerak bo’lgan narsalar

Har qanday qimor o’yini singari, Chicken Road o’z qoidalariga ega. Biroq, klassik slotlardan farqli o’laroq, bu erda hamma narsa boshqacha tartibga solingan. Ko’zni tortadigan birinchi narsa – yirtqichlar, scatterlar, bepul aylanishlar, bonusli davralar yoki avtomatik o’yinlar kabi tanish elementlarning yo’qligi. Bu shunchaki u erda emas.

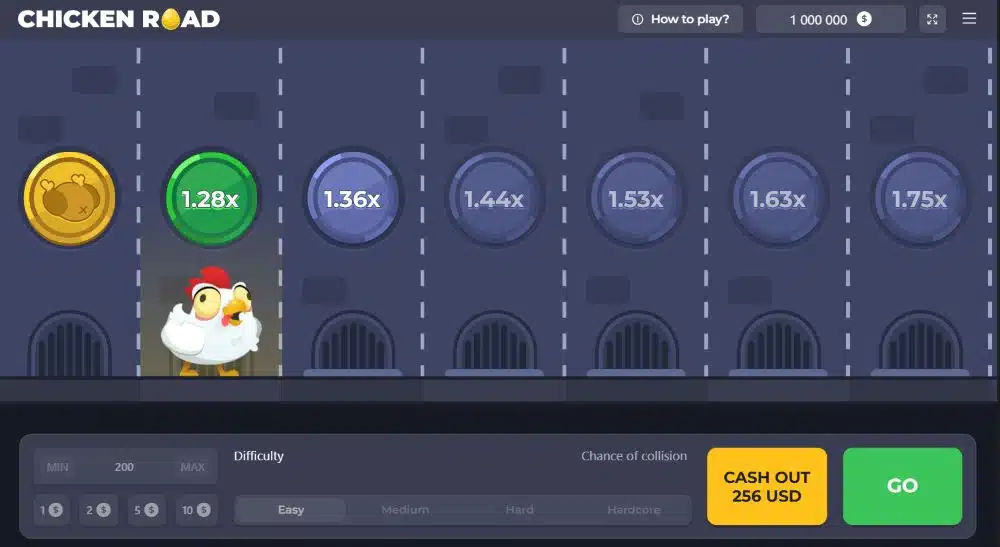

Buning o’rniga, ishlab chiquvchilar multiplikatorlar yordamida original mexanikni amalga oshirdilar. Har bir qadam bilan tovuq orzu qilingan Oltin tuxumga yaqinlashadi va koeffitsientlar u bilan birga o’sadi. Ammo multiplikator qanchalik baland bo’lsa, xavf shunchalik ko’p bo’ladi: yo’lda ham pul tikish, ham xarakterni yo’q qiladigan yong’in tuzoqlari mavjud. Aynan shu imkoniyat va xavf o’rtasidagi muvozanat o’yinni chinakam qiziqarli qiladi.

Qiyinchilik darajasi: osondan ekstremalgacha

Chicken Road – bu o’yinchidan doimiy konsentratsiyani talab qiladigan interaktiv arkada o’yini. U to’rtta qiyinchilik darajasiga ega:

- Oson

- O’rta

- Qattiq

- Hardkor

Har bir daraja o’ziga xos xususiyatlarga ega:

- Oson (oson daraja) – 24 satr, ko’paytirgichlar x1,02 dan x24,5 gacha o’zgaradi. Yo’qotish ehtimoli 24,5da 1.

- O’rta (o’rta daraja) – 22 chiziq, x1,11 dan x2254 gacha koeffitsientlar, yo’qotish ehtimoli – 3 dan 25 gacha.

- Qattiq (qiyin daraja) – 20 trek, multiplikatorlar x1,22 dan x52067,39 gacha, yo’qotish ehtimoli 5 dan 25 gacha.

- Hardkor (juda qiyin daraja) – 15 trek, koeffitsient x1,63 dan x3203384,8 gacha, yo’qotish xavfi – 10 dan 25 gacha.

Bir necha mashg’ulotlardan so’ng, boshlash uchun eng oson daraja Oson ekanligi ayon bo’ldi. Bu yangi boshlanuvchilar uchun juda mos keladi: bu sizga tezda o’zlashtirishga va hatto kichik multiplikatorlar bilan bo’lsa-da, pul ishlashga imkon beradi. Kamtarona potentsial g’alabaga qaramay, jarayonning o’zi juda ko’p ijobiy his-tuyg’ularni keltirib chiqaradi. Eng qiyin, lekin ayni paytda eng hayajonli darajasi Hardkor edi. Bu strategiya va chidamlilikni talab qiladi, lekin haqiqatan ham katta sovrinlarni qo’lga kiritish imkoniyatini ochadi. Ushbu parametr, albatta, tajribali foydalanuvchilarga va tegishli mukofot bilan yuqori xavfni afzal ko’rganlarga yoqadi.

Chicken Road Gambling: Barcha o’yinchilar uchun moslashuvchanlik

Chicken Road-ning asosiy afzalliklaridan biri bu garovlarning keng doirasi – ramziy 0,01 evrodan ta’sirchan 200 evrogacha. Bu o’yinni minimal xavfni afzal ko’rgan ehtiyotkor yangi boshlanuvchilar uchun ham, jiddiy pul tikishga tayyor bo’lgan tajribali o’yinchilar uchun ham ochiq qiladi. Biz garovlarning barcha diapazonini sinab ko’rdik – minimaldan maksimalgacha, shu jumladan oraliq qiymatlar. Shuni ta’kidlash kerakki, garov miqdori o’yin mexanizmiga ta’sir qilmaydi – bu faqat yakuniy to’lovga ta’sir qiladi, chunki sizning yutuqlaringiz garovni o’yin davomida erishilgan multiplikatorga ko’paytirish orqali hisoblanadi. Tanlangan summadan qat’i nazar, o’yinchi har doim istalgan vaqtda – tovuq tuzoqqa tushib qolmasdan oldin – to’xtashi va o’z yutuqlarini yig’ishi mumkin.

G’alaba qozonish imkoniyati: qancha pul olishingiz mumkin?

Chicken Road-da maksimal g’alaba Hardcore darajasida mavjud bo’lib, u erda eng yuqori multiplikator x3,203,384,8 da o’rnatiladi. Uni olish uchun siz tovuqni barcha 15 ta trekdan muvaffaqiyatli o’tkazib, uni asosiy jekpot ramzi bo’lgan Oltin tuxumga olib kelishingiz kerak. Ha, bu oson ish emas, lekin mukofot pulga arziydi. Misol uchun, maksimal 200 € tikish va yakuniy bosqichni muvaffaqiyatli yakunlash bilan yutuq miqdori €640 000 000 dan ko’proqqa yetishi mumkin – bu aql bovar qilmaydigan ko’rsatkich, ayniqsa o’yinning oddiy qoidalari va yuqori darajadagi ishtirokni hisobga olgan holda. Chicken Road turli mahorat darajasidagi o’yinchilar uchun juda jozibali bo’lib, foydalanish imkoniyati, xavf va potentsial mukofot o’rtasidagi muvozanatdir.

Chicken Road o’yinini muvaffaqiyatli o’ynash uchun maslahatlar

Bir qarashda, tasodifiy sonlar generatoriga (RNG) asoslangan o’yinda strategiyalar ma’nosizdek tuyulishi mumkin. Biroq, bu mutlaqo to’g’ri emas. To’g’ri yondashuv va aqlli harakatlar muvaffaqiyatga erishish imkoniyatingizni oshiradi. Mana sizga ongliroq va samaraliroq o’ynashga yordam beradigan maslahatlarimiz:

- Demo versiyasidan boshlang. Haqiqiy pul tikishdan oldin, o’yinni demo rejimida o’zlashtirishingizni qat’iy tavsiya qilamiz. Bu mutlaqo bepul va xavfsiz. Demo rejimida o’ynash sizga mexanikani yaxshiroq tushunishga, asosiy xatolardan qochishga va o’zingizni ishonchli his qilishga yordam beradi. Xavfsiz amaliyot ajoyib boshlanish nuqtasidir.

- Asta-sekin qiyinchilik darajasini oshiring. Darhol Hardkorga shoshilmang. Oson darajadan boshlang, bu erda xavf minimal va ko’paytiruvchilar hali ham ko’zni quvontiradi. Misol uchun, hatto 100 evro va x24,5 multiplikatori kamtarona tikish bilan siz minimal xavf bilan mustahkam miqdorga ega bo’lasiz. Qachonki siz qulayroq bo’lsangiz, siz qiyinroq darajalarga o’tishingiz va tikishni oshirishingiz mumkin.

- O’z vaqtida to’xtating. Xavf nafaqat qiyinchilik darajasi bilan, balki har bir yangi trek bilan ham ortadi. Shuning uchun, yana bir samarali strategiya – o’yinni bosqich tugashidan oldin tugatish. Maksimal multiplikator uchun butun miqdorni xavf ostiga qo’yishning hojati yo’q. Ko’pincha o’rta bosqichda to’xtab, yaxshi g’alaba qozonish foydalidir. Bu, ayniqsa, stavkalar va koeffitsientlar yuqori bo’lgan Hard va Hardcore darajalarida o’ynashda to’g’ri keladi.

Haqiqiy pul uchun o’ynashda asosiy moliyaviy javobgarlik qoidalariga rioya qilish muhimdir. Siz hech qachon:

- oxirgi yoki qarzga olingan pul bilan o’ynash;

- oldindan belgilangan chegaradan oshib ketish;

- his-tuyg’ularga beriling va mag’lubiyatdan keyin g’alaba qozonishga harakat qiling.

Chicken Road – bu yorqin va hayajonli o’yin, lekin siz unga sovuq bosh bilan yondashishingiz kerak. Bu siz undan haqiqiy zavq olishingiz va byudjetingizga zarar keltirmaslikning yagona yo’li.

Chicken Road o’ynash uchun ishonchli kazinoni qanday tanlash mumkin

Xavfsizlik, maxfiylik va adolat barcha mas’uliyatli o’yinchilar uchun ustuvor vazifalardir. Biz har doim faqat tasdiqlangan, litsenziyalangan onlayn kazinolarga ustunlik beramiz va Chicken Road yoki boshqa qimor o’yinlarini o’ynamoqchi bo’lgan har bir kishiga xuddi shunday qilishni qat’iy tavsiya qilamiz. O’yin klubini tanlashda biz quyidagi mezonlarga e’tibor qaratamiz:

- nufuzli regulyatordan amaldagi litsenziyaning mavjudligi;

- zamonaviy shifrlash protokollari (masalan, SSL) yordamida ma’lumotlarni himoya qilish;

- voyaga etmaganlarning kirishini cheklash;

- hisobni majburiy tekshirish;

- original litsenziyalangan dasturiy ta’minot mavjudligi;

- sertifikatlangan tasodifiy sonlar generatoridan (RNG) foydalanish.

Ushbu tekshirish firibgarlikning oldini olishga, ruxsatsiz aralashuvni bartaraf etishga yordam beradi va adolatli, shaffof o’yinni kafolatlaydi. Natijada, siz qulaylik, jarayondan zavq va yutuqning halolligiga ishonchga ega bo’lasiz.